Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Talking Shop

Two critical ad revenue growth areas for Google are YouTube and shopping ads – which means shopping on YouTube is a priority, to say the least.

The newest feature for YouTube shopping is a product display control so accounts can display a product or deal at a certain timestamp within a video, The Verge reports. Brands want their products or special deals to appear at the moment most likely to help them close a sale.

That’s hardly a new trick. QVC has been doing it for years.

But YouTube is also introducing a bulk tagging tool for affiliate products. Now, older videos that contain product reviews or promos can be retroactively tagged and take advantage of the timestamped display.

And there’s also a new bit of analytics coming for YouTube Studio, its creator rev-share program, that will show YouTube accounts which affiliate products generate the most revenue.

The improved affiliate controls come as YouTube removes other, more important controls. For instance, starting in November, creators will no longer be able to choose for themselves whether to serve pre-roll, post-roll, skippable or non-skippable ads. If they choose to run ads, Google will decide which type to show and when.

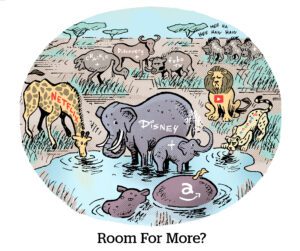

Streaming Dreaming

Amazon is approaching search advertisers, hat in hand, to offer a trade: If brands spend a $15,000 minimum for ads on Amazon Freevee and Twitch, Amazon will write, edit and produce the ads for them, The Information reports.

Amazon is clearly trying to parlay its healthy search ad business into CTV success ahead of next year’s Prime Video with ads debut.

Search units comprise the bulk of Amazon’s ad revenue, which was $10.7 billion in Q2.

But Amazon’s self-created video ads may not be ready for prime time. One brand that tried Amazon-produced creative found the commercial to be “a little too generic” and of lower production quality than expected, Avenue7Media consultant Jason Boyce tells The Information. The brand killed the ad once it reached its spend minimum.

Meanwhile, Amazon is also beta testing Sponsored TV, a self-serve advertiser feature that would allow brands to bid on streaming ad slots on Freevee and Twitch. And, in May, Amazon started working on AI photo and video generation tools that smaller merchants could use to make ads.

The Show Goes On

Connected TV advertisers haven’t tired of demanding show-level transparency.

Marketers are chasing targeting for specific program titles. “Many clients have very curated show lists and are asking us for episode synopses,” said Mike Fisher, executive director of investment innovation at GroupM, speaking at Advertising Week in New York City on Wednesday.

But CTV distributors are beholden to data-sharing agreements with individual publishers, many of which cite privacy as an excuse not to share competitive data.

Show-level transparency is limited because of the way content distribution agreements work, said Miles Fisher, senior director of ad platform sales and strategy at Roku, also speaking at AWNY.

So, how are CTV marketers supposed to know where their ads are running?

The safest bet, according to GroupM’s Fisher, is to buy directly through publishers, including programmatic guaranteed deals. Advertisers get more transparency that way, and it lessens the risk of buying fraudulent inventory.

Marketers that buy biddable CTV impressions should make sure they’re only using “trusted resellers,” he added. But how can advertisers know whether a reseller is trustworthy? Look at their ad prices.

“If you think you’re buying Warner Bros. Discovery inventory for $6 CPMs,” GroupM’s Fisher said, “you’re not.”

But Wait, There’s More!

Independent ad tech urges regulators not to stop at divestiture to rein in Google. [Digiday]

Yesterday, Twitter started charging new users in New Zealand and the Philippines $1 a year to access key features, including the ability to tweet and retweet. [Fortune]

OpenAI says it can detect AI-generated images with more than 99% accuracy. [Bloomberg]

Can Disney be a gaming company again? [Mobile Dev Memo]

You’re Hired!

IPG names Jayna Kothary as chief solutions architect. [release]